Call Us

PM Surya Ghar Muft Bijli Yojana

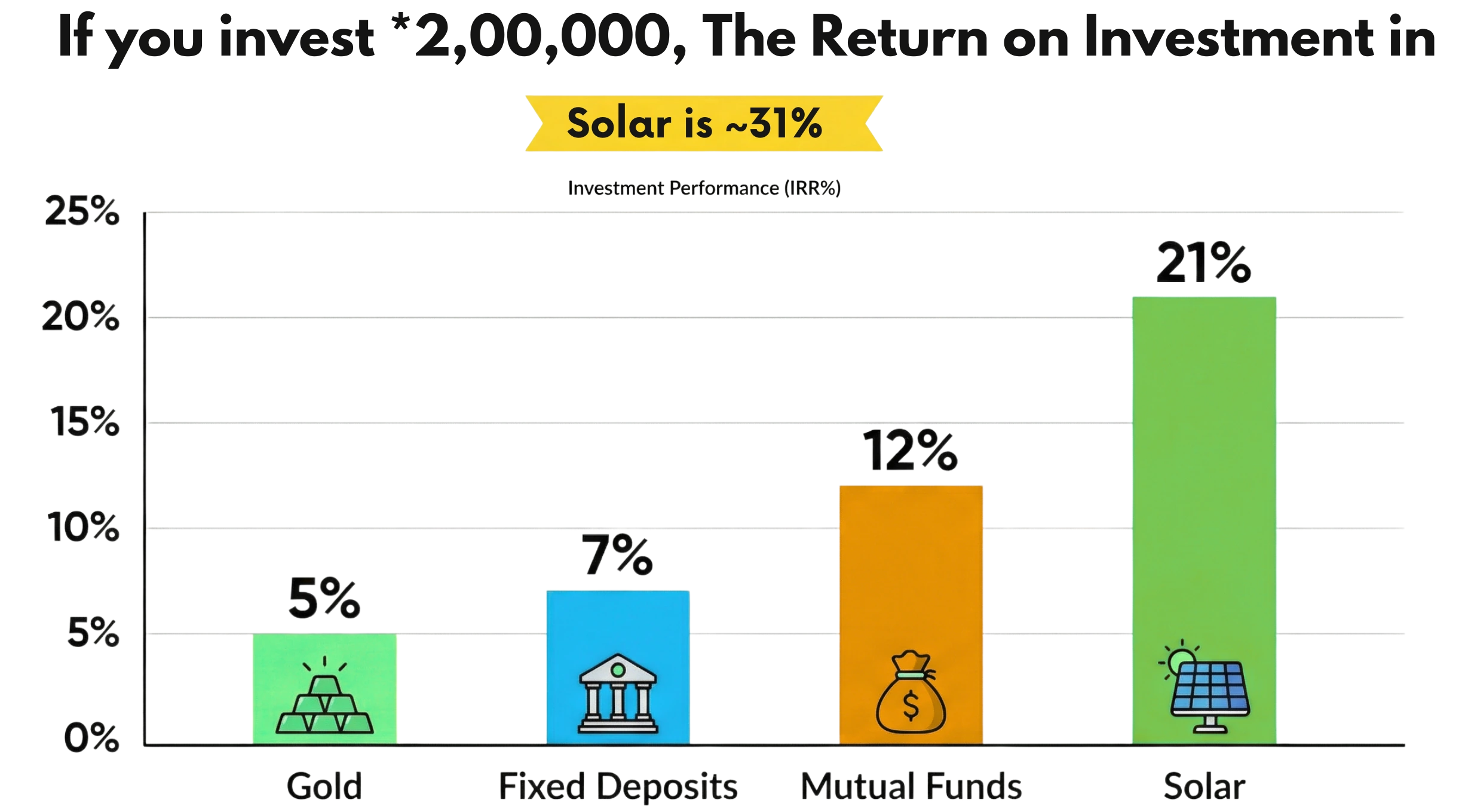

Prime Minister Narendra Modi on February 15, 2024. Under the scheme, households will be provided with a subsidy to install solar panels on their roofs. The subsidy will cover up to 40% of the cost of the solar panels.

Contact Us

-

-

Send Email

info@matertellus.in

-

Location

203, Sector 8, Indira Nagar

Lucknow - 226016,

Uttar Pradesh India